Decoding Homeowners Insurance: Will It Cover Your Roof Replacement?

December , 2023 | 7 min. read

For many homeowners, the thought of a roof replacement often sits quietly in the back of their minds. That is, until the unexpected strikes. Whether it's the gradual wear and tear of time or the sudden fury of a storm. Roofs have challenges that make them more important and urgent. From hail to wind storms, these elements can wreak havoc on your roof, often when you least expect it.

But here's a silver lining. As a homeowner, you have insurance that safeguards your property, right? Will this insurance cover the cost of replacing the entire roof? Many owners assume insurance covers all roof damage, but that's not always true. The reality is sometimes more complicated.

We've helped thousands of customers get roof replacements through homeowners' insurance. Our family at RoofCrafters has 30 years of experience. We understand that navigating insurance claims can be daunting. The last thing you want to face is a rejected claim when you need it the most. That's why it's important to have a clear understanding of your policy's specifics well in advance.

In this article, we'll discuss homeowners' insurance and roof replacements. You'll learn what types of roof damages are covered. We'll also explore what might be excluded, and how to approach your insurance claim. Hopefully, by the end, you'll have the information to help you navigate the claim.

Let's storm right in!

Understanding Insurance Coverage: What Roof Damages Are Included?

The point of having homeowner’s insurance is to cover losses and damage to your property if something unexpected happens, like a fire or burglary. That also includes roof storm damage caused by extreme weather such as hail storms. snowstorms, thunderstorms, and tornados. Which can lead to different types of property damage.

Dealing with Missing Shingles: Assessing Storm-Related Roof Damage

Missing shingles are a common type of damage that can result in significant water damage if left untreated. Oftentimes, wind storms will blow the shingles off the roof. When this happens, sometimes the shingles fly off taking the tar seal along with them.

Depending on the extent of the damage, some insurance companies will pay for the entire roof replacement while others will pay for a quick patch job. Getting a professional roofing contractor involved can help determine whether the damage is critical to justify the roof replacement insurance claim.

The Impact of Hailstorms: Navigating Roof Damage Claims for Hail

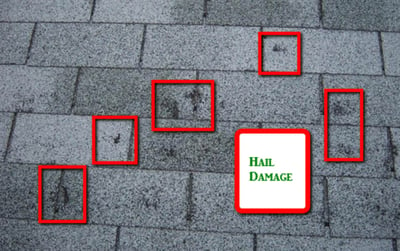

Many roof replacement claims are also associated with hail damage. Hailstorms can cause significant damage to roofing materials. The impact from a hailstone can bruise or crack asphalt shingles, cause gutters to fail, and affect things like skylights and chimneys, leading to potential water damage in your home.

How Can I Tell if I Have Hail Damage on My Roof?

There are 3 major signs of hail damage, which include:

- Bruising

- Cracking

- Missing granules

You can check for missing pieces in the asphalt of the roof. Look for areas on the shingle that have exposed, black substrate. This means the granules of the asphalt have been compromised or knocked off by a chunk of ice, a tree limb, or other falling debris. The best way to be certain of the state of your roof in the aftermath of a hailstorm is to have a professional involved.

Winter's Toll: Addressing Roof Damage from Snow and Ice Accumulation

Snow and ice can seriously affect the condition of your roof. During the frigid winter, the heavy weight of snow and ice will cause some stress on your roof. If the weight exceeds the roof’s snow load rating, the roof can cave in or collapse. Also, if it rains during this time, the rainwater will naturally flow to the lowest point of your roof and form large ice blocks once the temperature drops below freezing. As snow and ice build up, they create a barrier and prevent the water from draining properly. This can cause moisture.

Additionally, when melted snow and rain may not properly drain from the roof, they can find their way underneath the shingles, ultimately creating even more damage. If this happens continuously without proper care, it can lead to a big disaster. As always a professional can help you target the problem and determine if your insurance policy can cover the roof replacement.

Comprehensive Coverage: Insurance for Various Roof Damage Scenarios

When it comes to roof damage, it's not just the shingles and tiles at risk. Weather events can wreak havoc on other crucial parts of your roof as well. Powerful winds can harm your house by ripping off gutters or causing big branches to fall on them. Severe weather can loosen or harm roof flashings, which can cause leaks in your home. They play a crucial role in protecting your roof's structure.

Luckily, homeowner’s insurance usually covers these damages. If a tree or big branches fall on your roof during a storm and cause damage, your insurance will likely help. The damage can vary, from a small patch to replacing the entire roof, based on how severe it is. The insurance might cover everything or just some of the repairs. To get the help you need for your roof, know what your insurance covers.

Limits of Coverage: When Homeowner's Insurance Might Not Cover Roof Replacements

When paying for a roof replacement, homeowner’s insurance can come in handy. However, the insurance will not cover all types of damage. For example, roof leaks are only covered in certain situations. The insurance carrier will cover leaks if they are caused by a risk covered in the policy. Also, if the leak happened suddenly and didn’t accumulate over the years. You may or may not get the insurance to cover that.

The age of the roof can also determine if the insurance company will approve your roof replacement claim. The insurance may deny your claim if the roof is 15-20 years old. Unless the roof is well-kept and passes the inspection criteria. Other carriers will pay you the actual cash value of the roof. Meaning, if your roof only has a few damages and has passed the 20-year mark, you will get what the roof is worth after 20 years of depreciation.

In case of damage caused by pests like squirrels, or damage that may not have a negative impact on your home, the insurance company may deny your claim. Regardless, you should always consult with a professional roofing contractor because there are exceptions.

Navigating Insurance for Roof Replacement: Insights from RoofCrafters

Understanding what's covered in homeowner's insurance and roof replacements can be complex. The key to unlocking this lies in the expertise of choosing a professional contractor. This article explains insurance coverage for your understanding. This information can also help you determine if your claim will likely be approved.

Related Article: Insurance Roof Replacement Questions You Should Know

This resource will deepen your understanding and prepare you for discussions with your insurer.

At RoofCrafters we're not just contractors. We're your partners in making educated decisions about your home. We can help you with a thorough inspection, insurance complexities, and your next steps. We're here and ready to support you. Your concerns are our priority, and our team is dedicated to providing the clarity and help you need. Don't hesitate to reach out to us for all your roofing needs.

My name is Anthony, and I am the lead estimator of RoofCrafters’ Georgia/South Carolina division. The roof is the most important part of a structure, and people count on that to protect themselves and their families. That is one of the many reasons why I love my job and enjoy coming to work every day. The continuous training, honesty, and providing the customer with the Roofcrafters experience is what makes me the best in the business.