Tampa Homeowners' Guide: Can I Finance My Roof Repair or Replacement?

July , 2023 | 10 min. read

Roofing repairs or replacements can often come at the least opportune times. Catching homeowners in the Tampa Bay area off guard and stressing their finances. Your roof serves as the first line of defense against Florida's extreme weather. Including intense heat, heavy rain, and even hurricane conditions. So, ensuring it is in good condition is critical, regardless of the expense.

As a Tampa homeowner, you might be asking, "Can I finance my roof repair or replacement?" The answer is a resounding yes.

At RoofCrafters, we have spent over three decades working with Tampa Bay residents. By helping them upgrade their homes with durable, quality roofing while keeping their financial health in check. We understand that footing the entire bill upfront for a roof replacement or major repairs can be overwhelming.

Our mission is to help you protect your most significant investment. - your home - With top-quality roofing materials such as metal, tile, synthetic slate, or lifetime asphalt shingles. But our services go beyond installation. We also provide support and guidance when it comes to navigating the often complex world of roof financing.

We've answered countless queries about roof loans from homeowners just like you across Tampa Bay. With our experience and knowledge, we aim to provide information about roof financing options. We'll help guide you toward trusted financial institutions specializing in home improvement loans.

If you find yourself in need of more information about roof financing in Tampa, you’re in luck. We're going to answer the most common question we get asked about roof loans.

Let’s dive right in!

What Should I Know About Roof Loans in Tampa?

Roof loans in Hillsborough County are available in amounts up to $50,000. The loans are no money down, simple interest with no early payoff penalties.

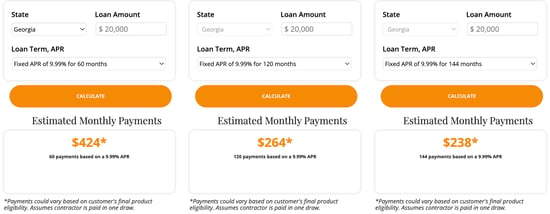

Roof loan interest rates range from 5.99% to 9.99%. The loan terms are 60 months, 120 months, or 144 months. For example, for a roof that cost $20,000, your monthly payment would be $464 for 60 months, $268 for 120 months, or $238 for 144 months with no down payment.

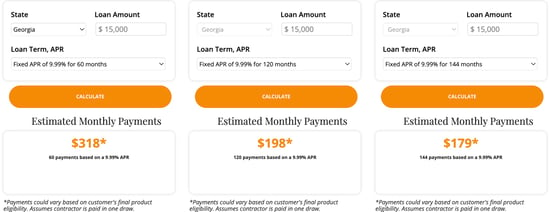

For a roof that cost $15,000, the monthly payment would be $318 for 60 months, $198 for 120 months, or $179 for 144 months, with no down payment.

Most homeowners in Florida go with a 10-year loan which is a 120-month term loan. It’s the most popular roof loan. This loan provides homeowners with more flexibility. Remember, there is no penalty if you choose to pay the loan off early. A roof loan is a simple interest loan.

To provide homeowners living in the Tampa Area of Florida we’ve partnered with Sunlight Financial. We can offer some of the best roof loans available. Sunlight provides flexible payment options and a frictionless home improvement loan experience. They also give elite support from loan approval to project completion and beyond.

As I mentioned, Sunlight loans can be paid off early with no prepayment penalties.

Understanding Interest Rates for Roof Loans in Tampa Bay

Whether you're a resident of South Tampa, Seminole Heights, or another charming neighborhood in the Tampa Bay area. You're likely wondering about the interest rates that go with roof loans. It's essential to comprehend these rates to make an informed decision about roof financing.

Despite the significant economic changes. As well as the inflation we've seen in the aftermath of the pandemic. Interest rates for roof loans have remained relatively steady. For our Tampa Bay clients, we partner with Sunlight Financial. They offer roof loan rates starting at a competitive 7.99% and going up to 12.99% under most plans.

The rate you qualify for depends on several factors. primarily your credit score and household debt-to-income ratio. These financial parameters provide lenders an insight into your ability to repay the loan. This helps them decide on a suitable interest rate.

But don't let these numbers scare you! At RoofCrafters, we're here to guide you through the process. By helping you understand the ins and outs of roof cost and financing for Tampa Bay homeowners.

What do Roof Loan Financial Lending Companies Consider “Good Credit”?

Instead of only discussing “good credit” in this section, let’s go over the brackets used for credit score standings. This will help provide you with a better understanding of credit score standings.

720 and up is an excellent credit score

- You shouldn’t have any trouble getting your roof financed with this credit score in this range.

- You’ll also qualify for a roof loan with lower interest rates.

660 to 719 is a good credit score

- You will be approved to borrow more money, which may result in a no-money roof loan.

- You’ll also qualify for lower interest rates.

600 to 659 is a fair credit score

- You may not be able to borrow as much money as a good credit customer, which means you may be required to put some money down to qualify for your roof loan.

- You will still get better interest rates than a poor credit customer.

599 and under is a poor credit score

- You may be required to put more money down

- You’ll likely only qualify for particular loans at higher interest rates

Keep in mind that lenders want to see a positive payment history with only a few late payments. Lenders will also consider your debt-to-income ratio. To make sure you are not overleveraged for your total family household income. A good number for the debt-to-income ratio is 55% debt to your total household income.

One of the best parts about applying for a roof loan through RoofCrafters using our partners at Sunlight is they offer pre-qualifying. That means they are able to conditionally approve you without any impact on your credit score.

Sunlight is able to do this by doing what is called a soft pull, which is a “soft credit” check. No social security number or financial documents are required to do a soft credit pull. In most cases, your name, your address, and your phone number are all that are required to get you pre-qualified for your roof loan.

Once you have been pre-qualified, you will be ready to proceed with the roof loan. After being pre-qualified we can determine your monthly payments. Once we have a plan that fits your budget we will have them proceed with the full application.

Roof Financing Options for Tampa Bay Residents with Poor Credit

It's not uncommon to have less-than-perfect credit, and we understand that life can sometimes throw a curveball. Fortunately, even if your credit score isn't the best, you still have options when it comes to roof financing in the Tampa Bay area.

Here are the top options:

- Raise your credit score

- Apply for a “special” poor credit loan

- Find a co-signer or co-applicant

- Get a secured loan

1. Boost Your Credit Score

Improving your credit score should be your first line of action, as a higher score can open the door to more favorable interest rates. Paying your bills on time, reducing your debt load, and regularly checking your credit reports for inaccuracies can all contribute to a better credit score. While it might take some time, the benefits to your financial health are well worth it.

It’s good to get your credit score as high as you can. The higher your credit score the lower your interest rate will be for your roof loan in Tampa. The fastest way to raise your credit is to pay off debt. You can check for errors and dispute them or hire a credit repair service and allow them to handle increasing your credit score.

2. Consider a “Special” Poor Credit Loan

Some lending companies offer special loans for borrowers who have low credit. You can expect to pay higher interest rates for these roof loans. The good news is you can still get the new roof. And when you pay off these higher-interest loans it'll raise your credit for the next time you need to borrow money.

To make financing available for applicants with lower credit scores. Our partners at Sunlight Financial have a special program. If you get denied roof financing because of your credit score or your debt-to-income ratio you may still be eligible for a special loan. You'll be required to meet their qualifications for this loan type.

3. Enlist a Cosigner or Co-Applicant

If you have a cosigner or co-applicant that person can help you qualify for the roof loan. They may help you qualify to get a better interest rate too.

Having a cosigner is another way to get your roof financed. They could help you get a much better loan agreement if your credit score is too low.

4. Explore Secured Loan

You could get a secured equity loan from your local credit union or your bank using the equity in your home, auto, or some other collateral.

- Home equity line of credit (HELOC)

- Borrow against your 401K

- Auto line of credit

These are just a few of the more frequently used options for getting a secured loan.

Information Required to Get Approved for Roof Financing in Tampa Bay

- Full legal name

- Address of your home

- Social Security # matching legal name

- Total Household Income (may require W-2s or tax returns)

Financing a Part of Your Tampa Bay Roofing Project: Is It Possible?

Absolutely! At RoofCrafters, we understand that financial circumstances can vary among our clients in Tampa Bay. Many choose to finance only a part of their roofing projects. Once you've qualified for a roof loan, you have the freedom to finance as much or as little of your roofing project as you prefer.

It's also important to remember that if you decide to pay off your roof loan early, there are no prepayment penalties. Early repayment of a simple interest loan can indeed save you money in the long run.

We hope that this information has illuminated the process and possibilities of roof financing and roof loans in the Tampa Bay area. If you're ready to take the next step and want to get pre-qualified, visit our financing page and click on the 'get pre-qualified button. Fill out the short form, submit your info, and one of our Tampa-based service representatives will reach out to you.

For any further questions about financing your roof in the Tampa Bay area, our family at RoofCrafters is here to help. From historic Ybor City to the quiet streets of New Tampa, we're committed to helping you make the best decision for protecting your home and family.

For any further questions about financing your roof in the Tampa Bay area, our family at RoofCrafters is here to help. From historic Ybor City to the quiet streets of New Tampa, we're committed to helping you make the best decision for protecting your home and family.

At RoofCrafters, our mission is to provide job opportunities for others to thrive and grow while making a meaningful impact within our communities.