Roof Financing 101: Options, Rates, and How to Get the Best Deal

December , 2023 | 7 min. read

Replacing your roof can be a major, and often unexpected, expense. But the good news is, you’re not alone in navigating this process. Many homeowners, like you, need help figuring out how to pay for such a significant investment. Whether you’re considering a roof replacement or simply weighing your options, it’s important to know that financing solutions are available to help ease the burden.

At RoofCrafters, we’ve helped thousands of homeowners secure financing over the past three decades, allowing them to protect their homes with high-quality roofing materials without breaking the bank.

So, if you’re in need of roof financing but aren’t sure where to start, this guide is for you. We’ll dive into roof loans, explore financing options, and share practical tips on how you can secure the right loan for your project. Let's dive in!

Understanding Roof Loans: Your Options Explained

Roof loans are available for amounts up to $50,000 and typically come with no money down, simple interest rates, and no early payoff penalties. The interest rates for roof loans range from 10.99% to 16.99%, depending on your credit score and debt-to-income ratio. Most homeowners opt for a 10-year loan, which spreads out payments over 120 months.

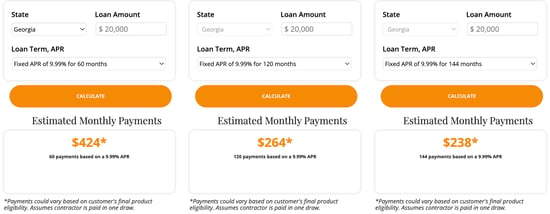

For instance, if your roof replacement costs $20,000, your monthly payment could be:

• $464 for 60 months

• $264 for 120 months

• $238 for 144 months

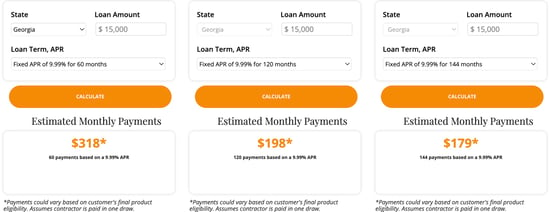

If your project costs $15,000, you’d be looking at:

• $318 for 60 months

• $198 for 120 months

• $179 for 144 months

No down payment is required. These loans offer flexibility, with no penalties for early repayment, so if you come into extra cash, you can pay off the loan ahead of time and save on interest. At RoofCrafters, we partner with Sunlight Financial, a trusted home improvement lender, to provide our clients in Florida, Georgia, and South Carolina with flexible financing options.

Sunlight Financial specializes in home improvement loans, offering a smooth, stress-free process from loan approval to project completion. Even better, they offer no prepayment penalties, which means you’re free to pay off your loan early without any extra fees.

Understanding Interest Rates in Roof Financing Options

Roof loan interest rates have remained relatively stable, even in our current post-pandemic economy. RoofCrafters’ financing partners offer rates between 10.99% and 16.99%, depending on your financial situation.

Your interest rate will depend on:

• Credit score: Higher scores will get you better rates.

• Debt-to-income ratio: Lenders want to make sure you can afford the loan.

What’s a Good Credit Score for Roof Financing?

Lenders look at your credit score when determining your eligibility for a loan. Here’s a breakdown of typical credit score categories:

• 720 and above: Excellent credit. You’ll have no trouble getting approved and will receive the lowest interest rates.

• 660-719: Good credit. You’ll still get approved for a loan, and you may qualify for a no-money-down option with competitive rates.

• 600-659: Fair credit. You may need to put some money down, and your interest rate will likely be higher.

• 599 and below: Poor credit. You’ll likely need to put down a significant amount and may only qualify for higher-interest loans.

Lenders also look at your payment history and your debt-to-income ratio (DTI), which should ideally be below 55% of your total household income.

One of the benefits of working with RoofCrafters and Sunlight Financial is the ability to pre-qualify for a loan without affecting your credit score. Sunlight performs a “soft pull” on your credit, which doesn’t require your social security number or financial documents - just your name, address, and phone number. This quick pre-qualification process lets you explore your options without any risk to your credit score.

Strategies for Securing Roof Loans with Poor Credit

- Raise your credit score

- Apply for a “special” poor credit loan

- Find a co-signer or co-applicant

- Get a secured loan

1. Raise Your Credit Score

It’s good to get your credit score as high as you can. The higher your credit score the lower your interest rate will be for your roof loan.

The fastest way to raise your credit is to pay off debt. You can check for errors and dispute them or hire a credit repair service and allow them to handle increasing your credit score.

2. Apply for a “Special” Poor Credit Loan

Some lending companies offer special loans for borrowers who have low credit. You can expect to pay higher interest rates for these roof loans. The good news is you can still get the new roof. And when you pay off these higher-interest loans it'll raise your credit for the next time you need to borrow money.

To make financing available for applicants with lower credit scores. Our partners at Sunlight Financial have a special program. If you get denied roof financing because of your credit score or your debt-to-income ratio you may still be eligible for a special loan. You'll be required to meet their qualifications for this loan type.

3. Find a Cosigner or Co-applicant

If you have a cosigner or co-applicant that person can help you qualify for the roof loan. They may help you qualify to get a better interest rate too.

Having a cosigner is another way to get your roof financed. They could help you get a much better loan agreement if your credit score is too low.

4. Get a Secured Loan

You could get a secured equity loan from your local credit union or your bank using the equity in your home, auto, or some other collateral.

- Home equity line of credit (HELOC)

- Borrow against your 401K

- Auto line of credit

These are a few of the more frequently used options for getting a secured loan.

Key Documentation and Criteria for Roof Financing Approval

- Full legal name

- Address of your home

- Social Security # matching legal name

- Total Household Income (may require W-2s or tax returns)

Financing Only Part of Your Roof Project

Many homeowners choose to finance just a portion of their roof replacement costs. Whether you’re paying for some of the work out-of-pocket or using savings to cover a portion, you can still secure a loan for the remaining amount. And remember, if you want to pay off your loan early, you can do so without any penalties.

Ready for Roof Financing? Taking the Next Steps with RoofCrafters

At RoofCrafters, we believe that roof financing shouldn’t be complicated. We hope this guide has answered your questions and provided clarity on the available options. If you’re ready to take the next step, you can pre-qualify for a roof loan today by visiting our financing page. Just click “Get Pre-Qualified,” fill out a short form, and one of our team members will be in touch to guide you through the process.

If you’re interested in learning more about other roofing options, such as metal roofing, check out our latest guide on choosing the best metal roof for your home.

If you have any questions about financing your roof or need assistance with your project, the RoofCrafters family is here to help. We look forward to helping you protect your home with a beautiful, durable roof that fits your budget!

At RoofCrafters, our mission is to provide job opportunities for others to thrive and grow while making a meaningful impact within our communities.